Payments are hot, sexy, unicorn-worthy (ok, maybe) — but, they are certainly not new. We are over a half century into ‘online’ payments. Originally, that meant connecting in real time (like from an ATM or, eventually, a POS) to get a y/n from a bank. Funds available? Amazing innovations in it’s time, online payments has continued to deliver greater control and flexibility to consumers, and introduced tremendous velocity into the economy.

This blog takes a look at the generations of change of enabling what we think of when we say “online payments” today – eCommerce. The Internet is increasingly the venue of choice for retail transactions – with both traditional “retail” items moving online and whole new merchant categories emerging. I attempt to lay out a way of thinking about the evolution of the payment technology that enables ecommerce. I believe a next generation of payments technology will unlock a wave of growth for eCommerce — for those that make the leap.

Generation 1 – Meet the new boss

After the internet’s invention (was it Al Gore or Tim Berners-Lee, I can never remember…) we started to inch our way to conducting commerce online. While the Pets.com sock

puppet did not, in the end, spell doom to all purveyors of goods in-person, it did give a face to a new industry with massive promise and potential to be over-hyped: eCommerce.

[Growth of eCommerce has been discussed at length and thankfully we are now beyond needing to debate eCommerce vs. POS. Instead we are now busy confusing ourselves about “OmniChannel” — but that is a different post (that I haven’t written yet, but there is always hope). This post is about the mundane but real changes that are happening now in eCommerce Payments technology.]

Internet payments are not a new trick. In my travels with BlueSnap I routinely encounter folks who have been selling on the web for 15+ years. I often discover that the same payment systems and checkout experience still stand from that initial release. Gen 1 of online payments is still in full flight at millions of merchants around the world. These Gen 1 payment rails are marked by a few tell-tale characteristics:

-

Rocking to payment terminals A cards only gateway delivered via rudimentary technology to the merchant’s bank. (*Important note, the Merchant is left to finding their own processing bank account)

- Checkout pages that feel more like an IRS tax form than a hip, cutting-edge, eCommerce experience.

- Better not try it on mobile.

- Reporting, reliability and advanced payment/routing functions do not exist. Basically — here is your deposit, good luck figuring out what it is for.

Gen 1 was incredible — we could conduct commerce on a computer. But, its been 15+ years and the internet moved on (mobile responsiveness, HTML5, SaaS and so on). It was high time for the payments ecosystem to evolve.

Generation 2 — I’m going Mobile

A few amazing things happened between 2005-07. Suddenly the “social web” became a core part of the internet experience – Facebook grew from an idea competing with MySpace to the landing page of a generation. Suddenly there was an alternative to Google as the source of information. Hot on the heals came the iPhone in 2007 and our idea of when we got to be on the Internet changed forever – it moved from a desk to our pocket.

As all this change rolled in, many in the payments industry didn’t react. Up popped the new age Payment Gateways / PSPs who built the technology, often in the form of  APIs, that made it possible to connect the old world payments system to this “Web 2.0” (#TBT – Wiki link here for those who forgot that term). Alongside, and often enabled by, this new technology development came a whole new world of payment experiences. Uber is the obvious example where payments (finally) started to become invisible.

APIs, that made it possible to connect the old world payments system to this “Web 2.0” (#TBT – Wiki link here for those who forgot that term). Alongside, and often enabled by, this new technology development came a whole new world of payment experiences. Uber is the obvious example where payments (finally) started to become invisible.

In fairness, Uber has the perfect use case for invisible payments. You pay for an

on-demand service in real-time, exclusively from a Mobile device. The delivery of the service is validated by the presence of your phone which validates your identity and validates that you received the service by your change in location (unless, of course, you have a jetpack). That said, the standard was reset with a new paradigm, the experience needed to be beautiful.

Thanks in large part to Steve Jobs, we are in the era of “designed” experiences. To excel in this landscape, many Payment Service Providers centered their efforts on the needs of the developer. The web developer has, in many cases, been thrust into the center of a decision that was historically the domain of the finance department. Suddenly, API issues like SOAP vs REST were determining factors in where to get payment processing. This shift happened subtly, but is now table stakes. This change snuck up on many players in the payments industry – to their great detriment. The arms race around tools for developers to make it “easy” to add payments has been raging – but, to what end?

Ultimately, the work of integration and ease of deployment is the critical (but brief) introduction to the beginning of the relationship between merchant and payments provider. The business value of the PSP shines through in operations – not in implementation. That is the fools gold of the Gen 2 model – just because something is easy to implement doesn’t mean it will be easy to operate.

The advancements in payments in Gen 2 cannot be understated though. The Gen 2 PSP is marked by a few key capabilities:

- Payment services, with a great few exceptions, can now be accessed with greater control and ease by merchants. Payment functionality that formerly required big IT projects to access now sit on the other end of an API call; available to merchants of all sizes.

- The availability of SDKs and extensive documentation further ‘democratize’ the power of big payments iron.

- The PSP offers all in one solutions that include the Gateway, Processing AND the Merchant account through one connection (difference explained in the BlueSnap blog here). This increased convenience sped up the deployment of online services.

- More and more value-added services exist in the platform – ranging from Alternative Payment types to Fraud Prevention to Subscription services.

What can be somewhat lost in this model is the idea that we are in this together for the success of the merchant’s business. In other words – the connection between making it easy for developers and business success has been an implied, not an explicit, connection. Several big changes are underway that will raise the bar on payments – easy to use simply won’t be enough:

- The world is getting smaller by the minute: Selling cross-border, for nearly all businesses, is at least a consideration – if not an active model. The complexity introduced when accepting payments around the world shows no sign of simplifying. Compliance, tax and regulatory walls put up by sovereign nations or regional/cultural norms in payment methods make enabling payments the right way in every country tricky.

- The rapid change of the interface (you thought the shift from Desktop to Mobile was hard, you better buckle up) will open up incredible opportunities to reduce friction and increase security in the payment process – but will be a non-trivial maze to manage. Mobile will continue to grow quickly, but the blurring between mobile, desktop and even wearable web will become harder and harder to discern. At some point soon we will all have to admit that it is all just the web and distinctions like m-Commerce vs. e-Commerce vs. IoT are just being made to sell software.

- The changing intersection of cost, compliance and user preference across payment types has never been harder to navigate. Understanding how to minimize payment costs while providing a great customer experience – and knowing when to make those tradeoffs – requires relentless analysis. The likelihood of all but the largest merchants being staffed with expertise to tackle this is low.

These emerging challenges, those that exist today (and those that we haven’t imagined) add up to yet another re-imagining of the role of the payments provider: consultative, solution-oriented and growth aligned.

Gen 3 – I’m Free (actually, its still 2.9%)

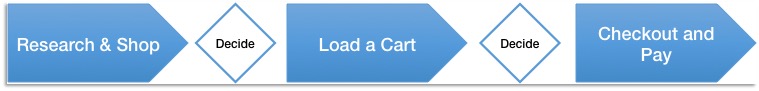

The costs of payments remain a big sticking point for many merchants. In a POS world, this makes particular sense. The sale is largely complete when the consumer hits the till; at that point, getting paid at the lowest cost with the least risk is what a merchant needs most. But even this straight forward decision is shifting. Traditionally, payments was a discrete element of a 3-part process.

This model leant itself to an obscured payment experience that did not need to be thought of as elemental to the customer experience. As mentioned earlier, the “Uber-effect” has changed that – and made it possible for new and better experiences to come along.

And yet, in the world of eCommerce, these same process steps have largely held true; most shopping cart systems follow this model. Certainly, Amazon pioneered the idea that you can keep selling all the way until the checkout – but even that experience remains a bit stuttered. Keeping shoppers in the happy phase of researching and shopping and minimizing (or making invisible) the administrative process of Cart Management and Checkout and Payments will lead to a better customer experience. A simple, idealized model could work well for retailers:

In the context of the challenges listed in the prior section, payment solutions providers need to re-think their role – moving from “enabling” eCommerce to “empowering” eCommerce. The payment step is now part of the selling process – or, more accurately, a part of the product being offered. It is not enough for a payments provider to offer technology tools, good pricing and reliability (btw – table stakes now, not differentiators). The real role of the eCommerce payments provider is to understand the elements required to make payments a compelling and frictionless element of the product/shopping experience for each merchant they work with. This means robust tools that are tailored to serve the geographical, U/X, industry and quirky needs of each merchant to best match up with their shoppers.

A tall task for sure. So – what does this next generation payment gateway need to help empower their merchant customers:

- Payment Methods: The complexity of eCommerce is undersold by just thinking about Cards. The reality is that there are large patches of the consumer market who would prefer (or only have) what are broadly referred to as “Alternatives”. These are often scoffed at by large payment providers as representing small fractions of the eCommerce landscape. The increasingly empowered consumer expects these to be available at their choosing. The next gen payment solutions provider needs to both enable and advise the best payment methods to offer. In the coming years, you could see this becoming a dynamic service that solution providers employ to allow merchants to serve up just the right mix to each shopper individually.

- Cross-border: I hope we don’t need to debate this one. Supporting cross-border as a payment solution provider means a whole lot more than supporting 100 currencies. This is about understanding checkout preferences by region, enabling local commerce and acquiring to insure high conversion rates and supporting nuanced regulations and cultural norms such as installment payments. Once again, having the capabilities is not enough. People, process and systems need to provide guidance to merchants on the best ways to reach shoppers locally – across the globe.

- Mobile and beyond: The opportunity for payments to become truly frictionless has never been better. The Digital Wallets that are making mobile shopping better than ever before will only get better – personalized, tied to biometric authentication, tying our rewards and PFM together. Payments Providers need to help merchants take advantage of these and future payment models that improve the customer experience.

- Fraud and Security: As the slice of the commerce pie on the web grows larger so to will the value for Fraudsters to target. Payments Providers are on the hook with the merchant to fight these risks. Real-time monitoring and sophisticated models must be brought to bear to help minimize fraud. The Payments Provider needs to help the merchant (and themselves) by avoiding the high cost of fraud and chargebacks.

Join Together with the band

As the next generation of Payment Solution providers design and offer services they must build with the intent of empowering their merchant customers not just with tools, but with the information and best practices to leverage the tools. Simply providing cool tech and a set of docs won’t be enough. Investing directly in the success of the merchant and insuring they are maximizing their revenue outcomes will be the primary way to differentiate to win (and retain) merchants.

Part and parcel will be the requirement of a global perspective. Whether directly or through partnerships, PSPs need to be able to empower AND advise merchants on the best steps to take when going global. This will continue to be a moving target as regions and countries evolve.

It is not likely that we will see 1 (or even 4) winners in the payment type/wallet wars that continue to rage. In all likelihood we are just beginning with proliferation of new digital identity technologies being enabled to connect to systems of value. The PSP must play the role of both adviser and agnostic evaluator. There cannot be bias brought to the table by the PSP as each merchant will have a unique set of payment types that suit them best

based on geography, ticket price, shopper demographics and other nuances. Having the access and know-how to navigate this confusion on behalf of the merchant is critical for the next generation PSP.

Meeting all these needs by definition requires partnerships. There is a long history of co-opetition in the payments arena. To help merchants succeed will require PSPs to work together not only with other payments providers and eCommerce ecosystems players, but look beyond to technology players, wallet providers and other consumer engagement platforms.

The future of the payments ecosystem will be marked by expansion. In many ways, the advent of the open APIs in the current Gen 2 platforms will be a key enabling factor of this future. As organizations like the W3C work (cool ideas at work here) on new ideas for simplifying eCommerce and removing friction there are 2 key requirements: shared standards and a willingness to partner. If PSD2 disrupts as much as it appears it could further accelerate advances (and change). As with most great advances in the Internet age, the rising tide will lift all (or most) boats. I believe the next 5 years will be more exciting than the last 15, as we usher in a smaller world and not just enable but empower merchants to succeed in it.